Capital One Auto Loan Rates: Top Tips for 2024 Success

Capital One Auto Loan Rates Overview

When it comes to understanding auto loan rates, being informed can help you make smart financial decisions. While many lenders offer competitive APR ranges, it’s important to explore various options to find the best fit for your credit profile. Generally, the best rates are reserved for those with excellent credit scores, but many lenders are open to borrowers with varying credit backgrounds.

Loan Terms and Options

Flexible loan terms are available, typically ranging from 36 to 72 months. This allows you to choose a repayment period that fits your financial situation. While longer loan terms might mean lower monthly payments, they can also result in more interest paid over the life of the loan.

Participating Dealers

A unique aspect of some auto financing options is that they may be limited to vehicles purchased through participating dealers. You can use tools similar to the Auto Navigator to browse vehicles from these dealers, ensuring transparency and convenience. These tools allow you to see estimated loan terms and monthly payments as you shop, helping you make a well-informed choice.

Pre-Qualification Process

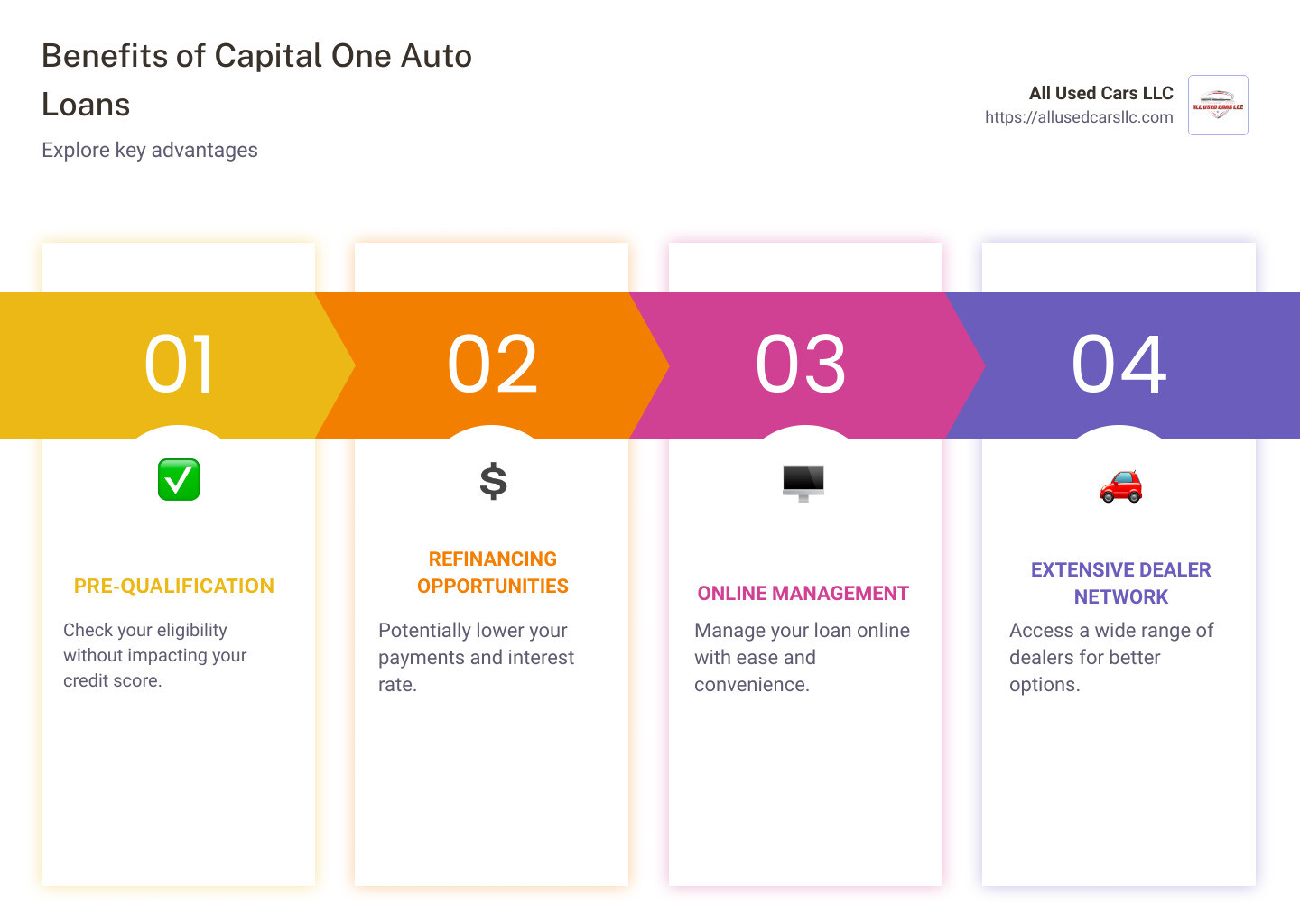

Before you head to a dealer, many lenders allow you to pre-qualify online with a soft credit inquiry, which won’t impact your credit score. This gives you an idea of the rates and terms you might qualify for, empowering you to negotiate better deals or compare offers from other lenders.

By understanding these elements of auto loan rates, you can better navigate the car financing landscape, ensuring you get the best possible deal for your needs. Whether you’re buying a new or used car or looking to refinance, exploring options can fit a variety of financial situations.

How to Qualify for Auto Loans

Qualifying for an auto loan begins with pre-qualification, a simple step that can save you time and stress. Pre-qualifying allows you to see potential loan terms without affecting your credit score. This is possible because many lenders use a soft credit inquiry during this process, which won’t leave a mark on your credit report.

Pre-Qualification Benefits

- No Impact on Credit: Unlike a hard inquiry, pre-qualification won’t harm your credit score. This means you can explore your options without worry.

- Quick and Easy: You can complete the pre-qualification process online in minutes, giving you a quick snapshot of what you might expect.

- Informed Shopping: Knowing your potential rates and terms helps you shop with confidence. You can compare offers and negotiate better deals at participating dealerships.

Credit Score Considerations

Your credit score is a key factor in determining your loan terms. Many lenders are known for their flexibility, often working with borrowers across a spectrum of credit scores. However, a higher credit score typically means better rates.

- Good to Excellent Credit: Scores of 690 and above usually qualify for the best rates.

- Fair to Poor Credit: Even if your score is lower, you might still find competitive terms. It’s always worth checking.

Preparing Your Application

To streamline the process, gather the necessary documents and information before applying. You’ll need:

- Social Security number

- Employment details

- Income information

- Housing status and payment details

By preparing these ahead of time, you can move through the application process smoothly and efficiently.

Understanding how to qualify for an auto loan can put you in the driver’s seat of your car financing journey. With the right preparation, you can secure terms that suit your budget and needs.

Understanding Auto Loan Rates

When you’re planning to finance a car, understanding your monthly payment is crucial. The auto loan calculator helps make this easy by focusing on three key inputs: loan amount, term length, and APR.

Loan Amount

The loan amount is the total sum you plan to borrow. This could be the full price of the car, or it might be less if you make a down payment or trade-in your old vehicle. A higher loan amount means higher monthly payments. So, consider how much you can afford to borrow.

Term Length

Term length refers to how long you have to repay the loan. Various options are typically available, ranging from 36 to 72 months.

- Shorter Terms: Higher monthly payments but less interest paid over time.

- Longer Terms: Lower monthly payments but more interest paid over time.

Annual Percentage Rate (APR)

The APR is the interest rate you’ll pay annually on your loan. It’s influenced by your credit score, loan amount, and term length. A lower APR means you’ll pay less interest over the life of the loan.

- Good Credit: Lower APR, saving you money.

- Poor Credit: Higher APR, costing more over time.

To get an idea of your potential APR, you can pre-qualify without affecting your credit score. This allows you to see estimated rates before committing.

How It All Works Together

By entering your loan amount, term length, and APR into the calculator, you’ll see an estimate of your monthly payment. This helps you understand how different factors affect your costs.

For example, if you borrow $25,000 with an APR of 9.50% over 60 months, your monthly payment might be around $525.05. Adjusting any of these factors can change your payment, helping you find a balance that fits your budget.

Using the auto loan calculator gives you a clearer picture of your financial commitment, allowing you to make informed decisions before heading to a dealership.

Frequently Asked Questions about Auto Loan Rates

What are current auto loan rates?

Auto loan rates vary based on several factors like loan term, loan amount, and credit score. Typically, borrowers with good or excellent credit scores (690 and above) might receive lower rates, while those with fair or poor credit could see higher rates. It’s always a good idea to check the latest rates on your lender’s website or use their online tools to get an idea of the rates you might qualify for.

Do lenders offer 72-month auto loans?

Yes, many lenders offer 72-month auto loans. This longer loan term can help reduce monthly payments, making it easier to fit a car payment into your budget. However, it’s important to note that while your monthly payment might be lower, you may end up paying more in interest over the life of the loan compared to a shorter term. Always consider the total cost of the loan, not just the monthly payment.

How does the pre-qualification process work?

The pre-qualification process is designed to be quick and easy, with no impact on your credit score. Here’s how it works:

- Submit Basic Information: Provide details like your Social Security number, income, and housing status.

- Soft Credit Check: The lender performs a soft inquiry, which does not affect your credit score, to give you an idea of the rates and terms you might qualify for.

- Explore Options: Once pre-qualified, you can review different loan offers without any commitment. This helps you make an informed decision about which loan fits your needs best.

Pre-qualification is a smart step to take if you’re considering financing a vehicle, as it provides clarity on what you can afford and helps you plan your purchase without affecting your credit score.

Conclusion

At All Used Cars LLC, we strive to make car buying a seamless and enjoyable experience. Our extensive dealer network across the USA gives you access to a wide selection of top-quality used vehicles at competitive prices. Whether you’re in Alabama, California, or New York, our network ensures that you can find the perfect car for your needs.

We understand that financing is a crucial part of the car-buying process. That’s why we offer secure and flexible financing options to fit a variety of budgets. Our partnership with lenders like Capital One allows us to provide competitive auto loan rates that can help you drive away in your dream car without breaking the bank.

By working with us, you not only get access to a vast inventory of vehicles but also benefit from our commitment to transparency and customer satisfaction. We encourage you to explore our selection of used cars for sale and experience the difference that All Used Cars LLC can make in your car-buying journey.

Drive smart, save more, and enjoy the ride with All Used Cars LLC.