Car Finance Rates: Top 5 Best Deals of 2024

Car finance rates play a crucial role when you’re on the hunt for a reliable used vehicle on a budget. Understanding these rates is key to ensuring you don’t spend more than necessary on financing your car. Here’s a quick glance at what you need to know:

- Competitive Rates: Always strive to find the best rates available for your credit score and financial situation.

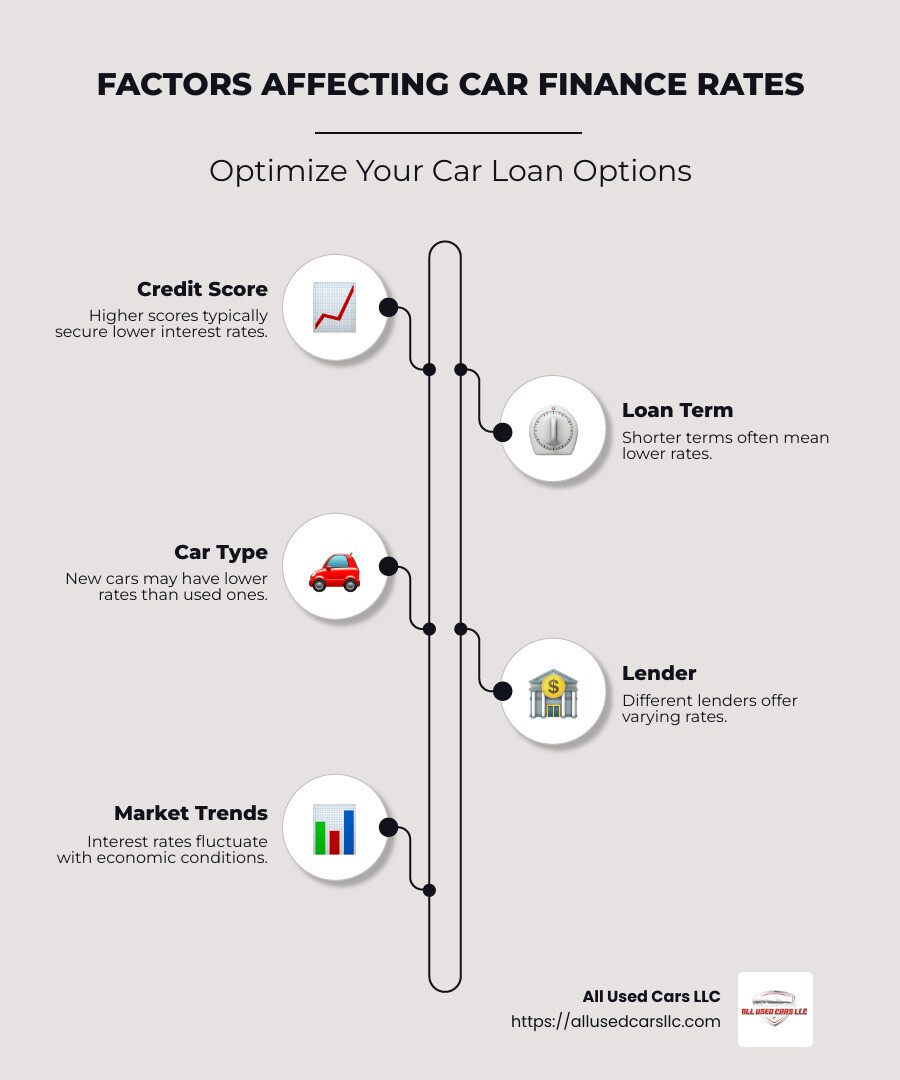

- Auto Loan Interest: Your credit score, loan term, and the type of car (new or used) significantly influence the interest rate you will receive.

When navigating car loans, knowing the range of rates based on credit scores can provide a benchmark for what you might expect. For instance, buyers with excellent credit scores tend to secure the lowest interest rates, while those with lower scores might face higher rates.

By understanding these basics, you are better prepared to compare offers and negotiate terms that suit your needs. This approach not only saves money but also aligns with the budgetary concerns of a cost-conscious car buyer.

Related content about car finance rates:

Understanding Car Finance Rates

When you’re financing a car, understanding interest rates is essential. These rates determine how much you’ll pay to borrow money for your vehicle. They depend on several factors, including your credit score, loan terms, and whether you’re buying a new or used car.

Interest Rates and Loan Terms

Interest rates are the percentage of the loan amount that you pay back to the lender over time. They can vary widely based on your credit profile and the type of vehicle. For instance, the average rate for a new car loan is generally lower than for a used car. In the third quarter of 2024, the average interest rate for a new car was 6.61%, while for a used car, it was 11.74%.

Loan terms, or the length of time you have to repay the loan, also impact your total cost. Longer loan terms might offer lower monthly payments but often come with higher interest rates, which means you’ll pay more over the life of the loan.

The Impact of Your Credit Score

Your credit score is a major player in determining your car finance rate. Lenders use it to assess your creditworthiness. Here’s a quick look at how different credit scores can affect your interest rates:

- Superprime (781-850): Typically, the lowest rates, around 5.08% for new cars.

- Prime (661-780): Slightly higher, with rates averaging 6.70%.

- Nonprime (601-660): Higher rates, around 9.73%.

- Subprime (501-600): Even higher, averaging 13.00%.

- Deep Subprime (300-500): The highest rates, about 15.43%.

Navigating Car Finance Rates

To get the best car finance rates, consider these steps:

- Check Your Credit Score: Know where you stand and take steps to improve your score if needed.

- Compare Offers: Don’t settle for the first offer. Shop around to compare rates and terms from different lenders.

- Consider Loan Terms: Balance the need for affordable monthly payments with the total interest cost over the loan’s life.

By understanding these elements, you can make informed decisions and potentially save a significant amount on your car purchase. This knowledge empowers you to negotiate better terms and ensures your payments align with your financial goals.

Top Car Finance Rates for New and Used Vehicles

When it comes to car finance rates, understanding the difference between new and used vehicle rates is crucial. Let’s explore how these rates vary and compare lenders to help you find the best deal.

New Car Rates

New cars often come with lower interest rates compared to used cars. This is because new vehicles are seen as less risky by lenders. In the third quarter of 2024, the average interest rate for a new car was 6.61%. If you have a superprime credit score (781-850), you might secure a rate as low as 5.08%.

Used Car Rates

Used car loans typically have higher interest rates due to the increased risk of depreciation and maintenance issues. The average rate for a used car in the same period was 11.74%. For those with a deep subprime credit score (300-500), rates can soar to around 21.55%.

Lender Comparison

Finding the right lender can make a big difference in your car financing costs. Here are some top lenders and what they offer:

- Navy Federal Credit Union: Best for military members, offering competitive rates and discounts.

- Chase: Ideal for those purchasing through dealerships in the Chase network, with streamlined financing processes.

- LightStream: Known for quick approvals and competitive rates, especially for borrowers with excellent credit.

- Capital One: Offers an easy pre-qualification process without affecting your credit score.

- Bank of America: Preferred by those who favor big banks, providing a range of options for both new and used cars.

By comparing these lenders, you can find the best rates that fit your financial situation. The interest rate is just one part of the cost. Be sure to consider the total loan terms to ensure you’re getting the best deal possible.

To make the most of your car financing, take the time to shop around and compare offers from different lenders. This way, you can secure the best possible rate for your new or used vehicle purchase.

Best Lenders for Car Finance Rates

When it comes to securing the best car finance rates, choosing the right lender can make all the difference. Here, we compare some of the top lenders to help you make an informed decision.

Navy Federal Credit Union

Navy Federal Credit Union is a top choice for those with military ties. They offer competitive rates and special discounts for service members. If you qualify, you can benefit from lower rates and flexible loan terms. Navy Federal also provides a Car Buying Service, powered by TrueCar®, which helps you find and finance the perfect vehicle with ease.

Chase

Chase is ideal for those who prefer purchasing through dealerships within the Chase network. They offer streamlined financing processes and often provide promotional rates for new vehicles. While Chase is known for its extensive network, your car must be purchased from a dealer in their network to qualify for their financing.

LightStream

If speed and convenience are what you seek, LightStream might be the best option. Known for their quick approval process, they offer competitive rates, especially for borrowers with excellent credit. LightStream provides a seamless online experience, making it easy to secure a loan without stepping into a bank.

Capital One

Capital One offers an easy pre-qualification process that doesn’t impact your credit score. This is perfect for those who want to explore their options without committing right away. Capital One is praised for its user-friendly online platform, allowing you to compare different loan offers effortlessly.

Bank of America

For those who prefer working with big banks, Bank of America is a solid choice. They offer a variety of loan options for both new and used cars and frequently provide discounts for existing customers. Bank of America’s robust mobile and online banking services also make managing your loan convenient.

By exploring these options, you can find a lender that aligns with your needs and financial situation. The right lender can help you secure the best car finance rates, saving you money over the life of your loan.

How to Secure the Best Car Finance Rates

Securing the best car finance rates can save you a significant amount of money over the life of your loan. Here are some practical steps to help you get the best deal:

Boost Your Credit Score

Your credit score is a key factor in determining the interest rate you’ll be offered. Lenders see a higher credit score as a sign that you’re a reliable borrower. Here are some tips to improve your credit score:

- Pay bills on time: Late payments can negatively impact your score.

- Reduce debt: Lowering your debt-to-income ratio makes you more attractive to lenders.

- Check for errors: Regularly review your credit report for mistakes and dispute any inaccuracies.

Get Loan Preapproval

Loan preapproval gives you a clear idea of the amount you can borrow and the interest rate you might receive. This process involves a soft credit check, which doesn’t affect your credit score. Here’s why preapproval is beneficial:

- Know your budget: Understanding your borrowing capacity helps you shop within your means.

- Leverage in negotiations: Preapproval can give you an edge when negotiating with dealers.

- Streamlined buying process: With preapproval, the final steps of purchasing a car can be quicker and less stressful.

Shop Around for Rates

Don’t settle for the first offer you receive. Compare rates from multiple lenders, including banks, credit unions, and online lenders. Here’s how to effectively shop around:

- Use online comparison tools: Websites can help you compare rates from different lenders quickly.

- Consider different types of lenders: Each lender might offer different terms, so explore options like credit unions, which often have lower rates.

- Look for promotional offers: Some lenders provide special rates during certain times of the year.

By following these steps, you can position yourself to secure the best possible car finance rates. This can lead to lower monthly payments and less interest paid over time, making your car purchase more affordable.

Next, let’s dive into some common questions about car finance rates to further clarify this important topic.

Frequently Asked Questions about Car Finance Rates

What is a good interest rate on a car loan?

A good interest rate on a car loan varies depending on your credit score and whether you’re buying a new or used vehicle. According to Experian’s data, if you have a superprime credit score (781-850), you might snag an average APR of 5.08% for a new car. For those with a prime credit score (661-780), the average is around 6.70%. On the other hand, if your credit is in the subprime range (501-600), expect rates to be much higher, averaging 13.00% for new cars.

How do I get the best car finance rates?

To secure the best car finance rates, focus on these strategies:

- Boost Your Credit Score: A higher credit score often leads to lower interest rates. Pay off debts, make timely payments, and check your credit report for errors to improve your score.

- Get Preapproved: Preapproval helps you understand potential loan terms and gives you a budget to work with. It can also provide leverage in negotiations with dealerships.

- Shop Around for Rates: Compare rates from various lenders, including banks, credit unions, and online platforms. Look for promotional offers that might offer lower rates.

Will shopping around for an auto loan hurt my credit score?

Shopping around for an auto loan doesn’t have to hurt your credit score. Most lenders use a soft credit check for preapproval, which doesn’t impact your credit score. Even when lenders perform a hard inquiry, credit scoring models usually treat multiple inquiries within a short period as a single inquiry. This means you can shop around for the best rates without significantly affecting your credit score.

By understanding these key aspects of car finance rates, you can make informed decisions and potentially save a lot of money over the life of your car loan.

Conclusion

At All Used Cars LLC, we understand how crucial it is to find the right car at the right price. That’s why we focus on offering competitive prices and an extensive dealer network across the USA. Our mission is to make your car buying experience as smooth and affordable as possible.

With locations in states like California, Texas, and Florida, we provide access to top-quality used vehicles. Our vast network ensures that you have a wide selection to choose from, no matter where you are. Whether you’re looking for a family SUV, a compact car, or a reliable truck, we’re here to help you find your perfect match.

Our commitment to competitive pricing means you can drive away knowing you’ve gotten a great deal. We work hard to secure the best car finance rates for our customers, collaborating with trusted lenders to offer you options that fit your budget.

Ready to explore our inventory? Visit our Used Cars for Sale page to see our current offerings. Let us help you drive down costs and find the car that’s right for you.