Cheapest Car Loan Deals: Top 5 Amazing Offers 2024

Finding the Best Deals on Car Loans

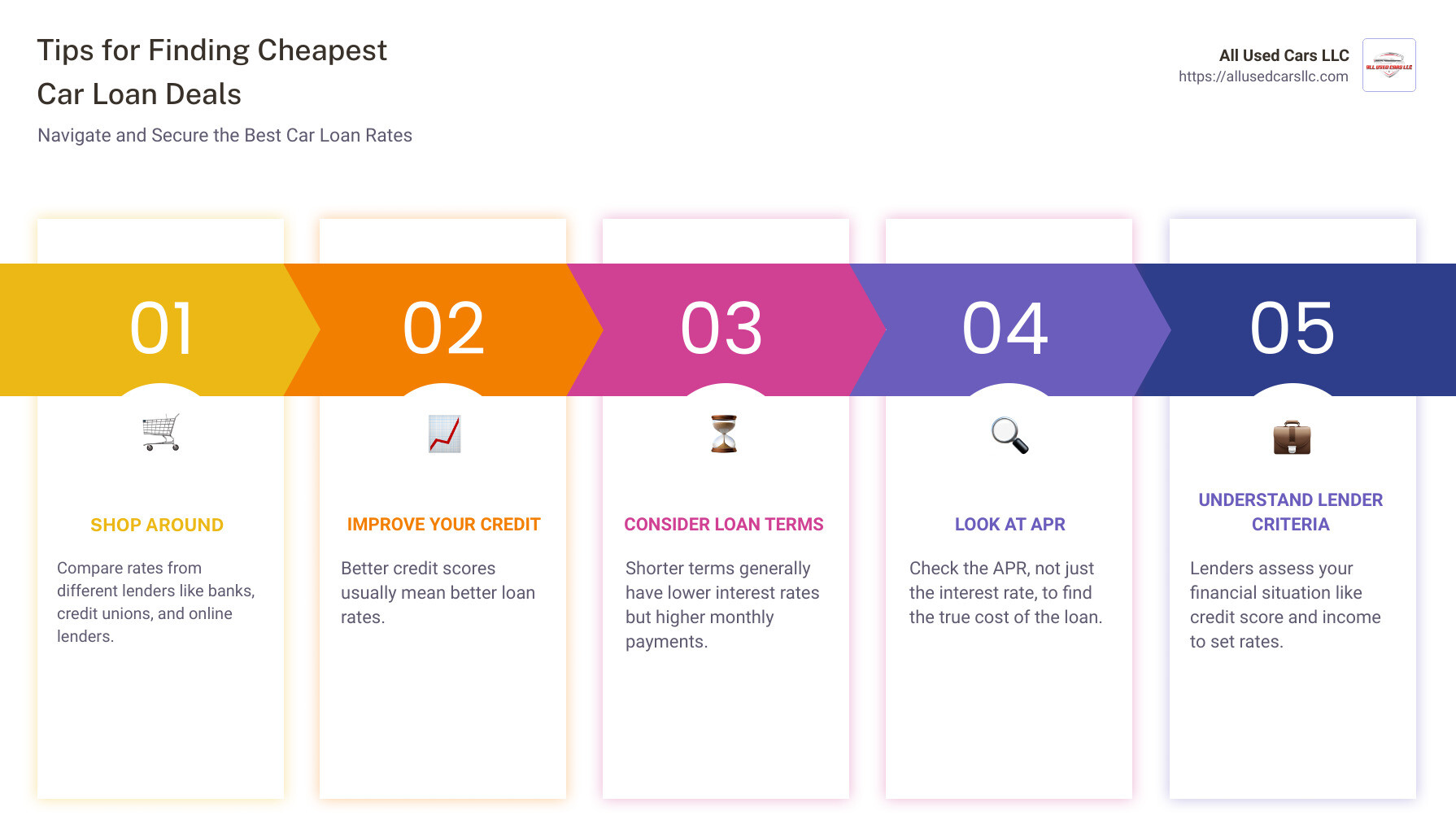

When it comes to cheapest car loan deals, navigating through various financing options and interest rates can feel overwhelming. However, finding an affordable auto loan is crucial for anyone on a budget looking to purchase a reliable used vehicle. Here’s a quick snapshot to guide you:

- Shop Around: Don’t settle for the first offer. Compare rates from different lenders like banks, credit unions, and online lenders.

- Improve Your Credit: Better credit scores usually mean better loan rates.

- Consider Loan Terms: Shorter terms generally have lower interest rates but higher monthly payments.

- APR Matters: Look at the APR, not just the interest rate, to find the true cost of the loan.

Whether you’re in Alabama, California, or New York, the key to securing a competitive car loan is understanding how interest rates work and taking advantage of the best offers. Lenders assess your financial situation using factors like credit score and income to determine the rate they can offer. Being prepared and informed is your best strategy to steer clear of high rates.

Understanding Car Loan Interest Rates

When you’re on the hunt for the cheapest car loan deals, knowing how interest rates are determined is essential. Lenders consider several key factors that influence the rate you’ll receive. Let’s break them down:

Credit Score

Your credit score is a major player in determining your interest rate. A higher score indicates that you’re a reliable borrower, which can lead to lower interest rates. On the other hand, a lower credit score might mean higher rates, as lenders perceive more risk.

Tip: Before applying for a loan, check your credit score and take steps to improve it if necessary. Paying bills on time and reducing debt can help boost your score.

Loan-to-Value Ratio (LTV)

The loan-to-value ratio is the amount you’re borrowing compared to the car’s value. A higher LTV means you’re borrowing more relative to the car’s worth, which can result in higher interest rates. Lenders see this as riskier because there’s less equity in the car.

Tip: Consider making a larger down payment to reduce your LTV and potentially secure a better rate.

Debt-to-Income Ratio (DTI)

Your debt-to-income ratio measures how much of your monthly income goes towards debt payments. A lower DTI suggests you have more disposable income, making you a less risky borrower. This can help you qualify for lower interest rates.

Tip: Aim to pay down existing debts to improve your DTI before applying for a car loan.

Vehicle Age

The age of the vehicle can also affect your interest rate. Older cars often come with higher rates because they are perceived as more likely to need repairs, posing a greater risk to the lender.

Tip: If you’re considering a used car, weigh the potential savings on the purchase price against possibly higher interest rates.

Understanding these factors can empower you to take control of your car loan search. By improving your credit score, managing your debts, and making smart vehicle choices, you can position yourself to secure the most favorable interest rates available.

Cheapest Car Loan Deals

Finding the cheapest car loan deals can be a game-changer when buying a vehicle. Let’s explore some top lenders known for offering competitive rates.

Axis Bank

Axis Bank is a standout for offering some of the lowest interest rates, starting at 8.70%. If you’re in the market for a car loan, this could be a great option to explore. They focus on providing affordable financing solutions, making them a top choice for budget-conscious borrowers.

Tesco Bank

Tesco Bank is another lender that offers attractive loan deals, especially for those with good credit. They provide flexible terms that can be custom to fit your financial situation, which can help keep your monthly payments manageable.

Santander

Santander is well-known for its competitive rates and customer-friendly loan terms. They often have special promotions, making it worthwhile to check their current offers when you’re shopping for a car loan.

TSB

TSB offers straightforward car loans with competitive interest rates. They are known for their transparent process, which helps borrowers understand exactly what they’re getting into without hidden fees or surprises.

LightStream

LightStream, a division of Trust Bank, is famous for its quick car loans and AutoPay discount. If you have excellent credit, you can benefit from their low rates and fast approval process. Plus, their online platform makes applying for a loan simple and efficient.

Consumers Credit Union

Consumers Credit Union offers very competitive rates and flexible terms. They also provide the option to add a co-signer, which can help you secure better loan terms if your credit score isn’t perfect.

Alliant Credit Union

Alliant Credit Union is known for its member-friendly services and low rates. They offer a range of loan products, including car loans with no early payoff penalties, which can save you money if you decide to pay off your loan ahead of schedule.

These lenders are recognized for their affordable car loan deals, but rates can vary based on your personal financial situation. It’s always a good idea to shop around and compare offers to find the best deal for you.

Top 5 Lenders for Affordable Car Loans

When looking for the cheapest car loan deals, it’s crucial to consider lenders that offer low rates and favorable terms. Here’s a closer look at five top lenders that stand out for their affordable car loan options.

Axis Bank

Axis Bank is renowned for offering one of the lowest interest rates in the market, starting at an impressive 8.70%. This makes them a top contender for anyone seeking to minimize their borrowing costs. Their straightforward application process and competitive rates make Axis Bank an excellent choice for those looking to save on interest.

LightStream

LightStream, part of Truist Bank, is a popular choice for those needing quick car loans. They offer an AutoPay discount, which can further reduce your interest rate if you set up automatic payments. Known for their fast approval process and efficient online platform, LightStream is ideal for borrowers who value speed and convenience.

PenFed Credit Union

PenFed Credit Union is particularly appealing to individuals with military ties. They offer unique cash incentives and competitive rates, making them a top choice for members of the military community. PenFed’s customer-focused approach and attractive loan terms are designed to support service members and their families.

Capital One Auto Finance

As a big bank, Capital One Auto Finance provides a robust set of online tools to help you manage your auto loan. Their platform allows you to pre-qualify for a loan without affecting your credit score, giving you a clear picture of what you can afford before you start shopping. Capital One’s reputation for reliability and comprehensive services makes it a solid choice for many borrowers.

MyAutoLoan

MyAutoLoan stands out for its emphasis on rate shopping and the ability to receive multiple offers from different lenders with just one application. This approach allows borrowers to easily compare rates and terms, ensuring they find the best deal available. MyAutoLoan is especially beneficial for those with fair credit, offering flexible acceptance criteria and transparent rates.

These lenders offer some of the most affordable car loan deals available. However, review each option carefully and choose the one that best fits your financial needs and situation.

Tips for Securing the Best Car Loan Rates

When it comes to securing the best car loan rates, a little preparation can go a long way. Here are some essential tips to help you get the cheapest car loan deals possible:

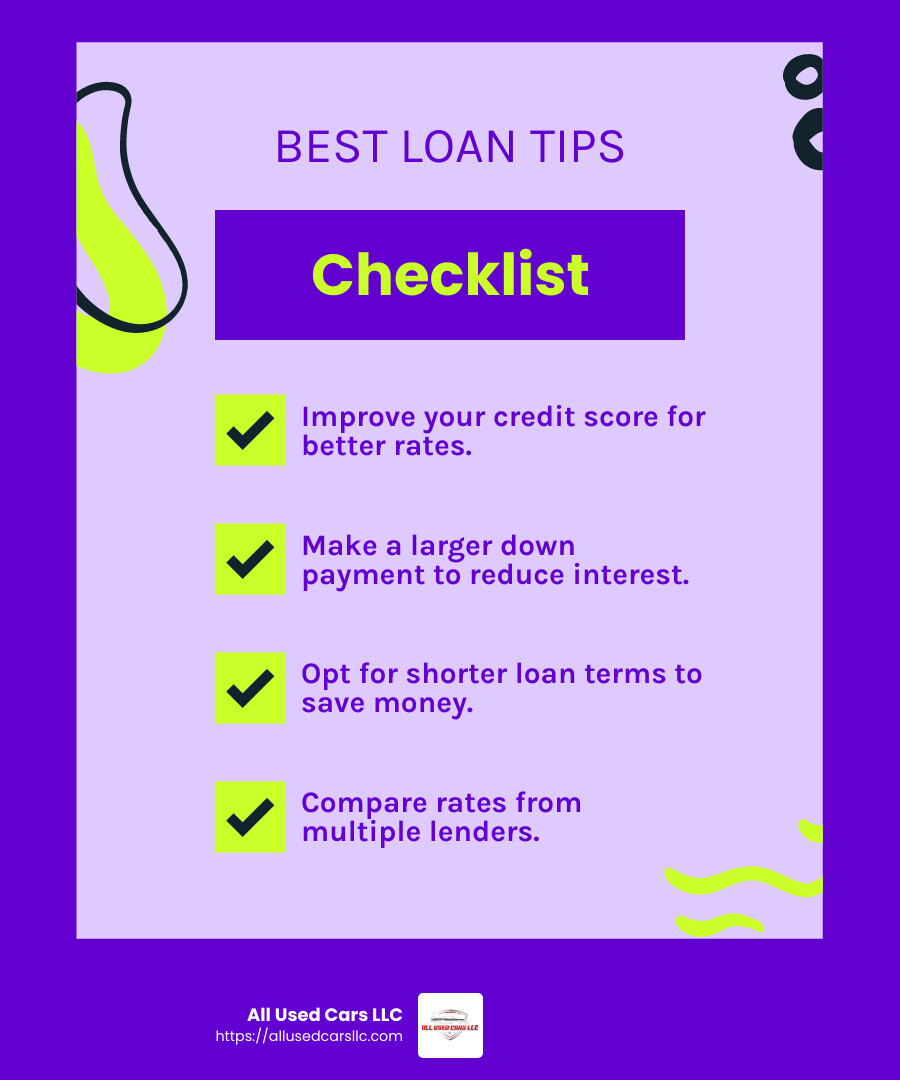

Improve Your Credit Score

Your credit score plays a significant role in determining your car loan interest rate. Lenders see a higher credit score as a sign of reliability, which can lead to lower rates. Before applying, check your credit report for errors and pay down existing debts. Taking these steps can improve your credit score and help you qualify for better rates.

Make a Larger Down Payment

A larger down payment reduces the amount you need to borrow, which can lead to a lower interest rate. Aim to put down at least 10% to 20% of the car’s purchase price. This not only lowers your monthly payment but also decreases the overall interest you’ll pay over the life of the loan.

Choose the Right Loan Term Length

Loan term length affects both your monthly payments and the total interest you’ll pay. While longer terms might offer smaller monthly payments, they usually come with higher interest rates. Opting for a shorter term can save you money in the long run, even if the monthly payments are higher. Balance what you can afford monthly with the desire to pay less in interest overall.

Compare Rates from Multiple Lenders

Don’t settle for the first offer you receive. Take the time to shop around and compare rates from various lenders, including banks, credit unions, and online lenders. Pre-qualification processes often use a soft credit inquiry, allowing you to see potential rates without affecting your credit score. This step is crucial for finding the most competitive rates available.

By following these tips, you can improve your chances of securing a car loan that fits your budget and minimizes your costs. In the next section, we’ll address common questions about car loans to further guide you in your car-buying journey.

Frequently Asked Questions about Car Loans

Which bank gives the cheapest car loan?

When searching for the cheapest car loan deals, it’s important to compare offers from multiple lenders, as rates can vary based on your credit profile and other factors. Many banks and financial institutions offer competitive rates, so it’s beneficial to shop around and find the best deal that suits your needs.

What is a good car loan interest rate?

A good car loan interest rate can vary depending on several factors, such as your credit score and the loan term. Generally, a rate below 5% is considered excellent for those with a high credit score (above 780). For used cars, rates are typically higher, averaging around 11.74% according to Experian’s 2024 report. Improving your credit score can significantly impact the APR you qualify for.

Can I negotiate my rate on an auto loan?

Yes, you can negotiate your auto loan rate. Start by understanding your credit score and the average rates for your credit tier. Approach lenders with confidence and be prepared to discuss terms. Sometimes, offering a larger down payment or opting for a shorter loan term can give you leverage in negotiations. Many lenders allow rate shopping, providing multiple offers to compare and negotiate. Always review the lender terms carefully to ensure you’re getting the best possible deal.

Conclusion

At All Used Cars LLC, we understand that finding the right car loan is just as important as finding the right car. Our extensive dealer network across the USA allows us to offer a wide selection of top-quality used vehicles at competitive prices. This positions us uniquely to help you not only find the car you want but also secure the cheapest car loan deals available.

Our partnerships with various lenders mean we can connect you with financing options custom to your needs. Whether you’re looking for low interest rates like those offered by Axis Bank or quick approvals through LightStream, we’ve got you covered. We believe in transparency and simplicity, ensuring that you understand every step of the financing process.

Choosing All Used Cars LLC means choosing a partner committed to your satisfaction. Our goal is to make your car buying experience as smooth and affordable as possible. With our competitive prices and secure financing options, we’re here to help you drive away in the car of your dreams without breaking the bank.

Ready to explore our selection of used cars and find the best financing option for you? Check out our inventory and financing options today!