Bad Credit Car Loans: Top 5 Proven Tips 2024

Navigating Bad Credit Car Loans: Your Path to Affordable Financing

Bad credit car loans can open the door to a new vehicle, even if your credit score isn’t as strong as you’d like. We’ve laid out a straightforward path for you to explore financing options and secure the best possible deal despite having less than perfect credit. Here’s a quick look:

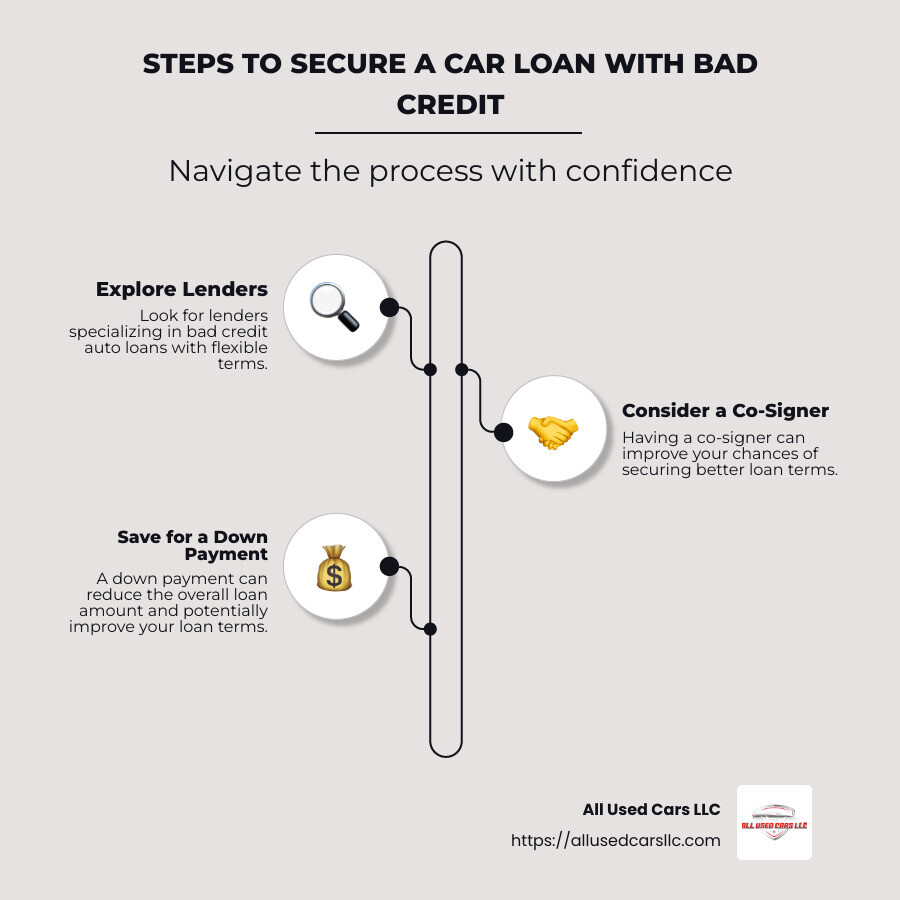

- Explore lenders: Seek out those specializing in bad credit auto loans with flexible terms.

- Consider a co-signer: This can often improve your loan terms and conditions.

- Shop around: Compare offers to find the most competitive interest rates.

- Save for a down payment: It can reduce your overall loan amount and potentially improve terms.

When you’re searching for a new or used car, finding affordable financing can be the most daunting part. But take heart; you’re not alone. Many lenders understand that life’s circumstances can impact your credit score. Whether it’s past financial struggles or a thin credit history, subprime lenders are ready to offer second-chance loans custom to your needs.

At All Used Cars LLC, we believe everyone should have access to reliable transportation without breaking the bank. With locations nationwide, including in major states like California and Texas, we aim to make vehicle financing transparent and straightforward for budget-conscious buyers.

Bad credit car loans vocabulary:

Understanding Bad Credit Car Loans

Bad credit car loans are designed for individuals with less-than-ideal credit scores. These loans are often referred to as subprime auto loans. They allow people with poor credit histories to finance a vehicle purchase, providing an opportunity to rebuild their credit through consistent payments.

Subprime Auto Loans

Subprime auto loans are specifically custom for borrowers with credit scores typically below 620. These loans come with higher interest rates due to the increased risk lenders take on. According to NerdWallet, the average interest rate for a used car loan for a subprime borrower can be significantly higher than for those with better credit.

High Interest Rates

Interest rates for bad credit car loans can vary widely. While it’s common to see rates above 10%, some lenders may offer lower rates based on other factors, such as income stability or the size of the down payment. It’s vital to shop around to find the most competitive rates available.

Pro Tip: Consider getting prequalified to understand what interest rates you might qualify for without impacting your credit score.

Limited Options

While there are options for securing a car loan with bad credit, they are more limited. Some traditional banks might not offer loans to subprime borrowers. However, there are specialized lenders and online platforms, like Credit Acceptance Corp and Carvana, that cater to this segment. These lenders often have more flexible requirements, such as no minimum credit score or a willingness to consider past bankruptcies.

In Summary:

- Subprime Auto Loans: Custom for low credit scores but come with high interest rates.

- Higher Costs: Expect to pay more in interest over the life of the loan.

- Fewer Lenders: Not all lenders offer subprime loans, so seek out specialists in this area.

By understanding these elements, you can better steer the landscape of bad credit car loans. This knowledge will aid you in making informed decisions while working towards securing the best possible financing for your new or used vehicle.

Steps to Secure a Car Loan with Bad Credit

Securing a car loan with bad credit might seem daunting, but it’s possible with the right approach. Here’s a step-by-step guide to help you steer the process effectively.

Improve Your Credit

Before applying for a bad credit car loan, it’s wise to first work on improving your credit score. Even small improvements can make a significant difference in the interest rates you are offered.

Steps to Boost Your Credit:

- Pay Bills on Time: Consistently paying your bills by their due dates can positively impact your credit score.

- Reduce Debt: Lowering your overall debt can improve your credit utilization ratio, which is a key factor in your credit score.

- Check for Errors: Obtain a free credit report and review it for any errors. Disputing inaccuracies can sometimes lead to an immediate score increase.

Make a Down Payment

A substantial down payment can greatly improve your chances of getting approved for a car loan. It reduces the lender’s risk and can lead to better loan terms.

Benefits of a Down Payment:

- Lower Loan Amount: A bigger down payment means you borrow less, which can reduce your monthly payments and total interest paid.

- Better Interest Rates: Lenders may offer more favorable interest rates if you can make a larger down payment.

- Increased Approval Chances: Demonstrating financial commitment can make lenders more willing to approve your loan.

Shop Around

Don’t settle for the first loan offer you receive. Shopping around is crucial to finding the best rates and terms.

Where to Look:

- Online Lenders: Platforms like Carvana and Credit Acceptance Corp offer competitive rates and cater to those with bad credit.

- Credit Unions: Often have programs designed to help those with poor credit histories.

- Local Banks: Your existing bank or credit union might offer special terms for long-time customers.

Tip: Use prequalification tools to compare rates without affecting your credit score.

In Summary:

- Improve Your Credit: Small changes can lead to better loan offers.

- Down Payment: Save up to make a significant down payment.

- Shop Around: Compare offers from different lenders to find the best deal.

Taking these steps can help you secure a car loan with bad credit and drive away in a vehicle that fits your budget and needs.

Top Lenders for Bad Credit Car Loans

When you’re searching for a bad credit car loan, know which lenders can offer you the best options. Here are some top choices that cater to individuals with less-than-perfect credit scores:

MyAutoLoan

Why MyAutoLoan Stands Out:

MyAutoLoan is an online marketplace that connects borrowers with lenders. It’s a great tool for comparing offers, as it can provide you with up to four loan proposals in just a few minutes. They offer a variety of loan types, from new and used car loans to refinance options.

Key Features:

- Loan Types: Offers new and used car loans, private party loans, lease buyout, and refinancing.

- Eligibility: Generally requires a minimum credit score of 600 and an income of at least $21,600.

- Bankruptcy Consideration: Lenders in their network may work with applicants who have a discharged or dismissed bankruptcy.

Carvana

Why Carvana is Unique:

Carvana is a one-stop shop for buying a car and securing financing. They offer a completely online experience, which is convenient for those who prefer not to visit a dealership. However, financing is only available for cars purchased through Carvana.

Key Features:

- Convenience: 100% online application and car purchasing process.

- Loan Terms: Offers terms ranging from 3 to 6 years.

- No Negotiation: Prices are set, which can simplify the buying process but may limit your ability to haggle.

Credit Acceptance Corp

Why Credit Acceptance Corp is Noteworthy:

Credit Acceptance Corp specializes in providing loans to individuals with financial challenges, including those with open bankruptcies. They work through a network of participating dealerships, which means you need to find a dealer that partners with them.

Key Features:

- Loan Types: Financing for new and used vehicles through participating dealerships.

- Bankruptcy: Will consider applicants with open bankruptcies.

- Availability: Operates in all 50 states, but dealership locations may vary.

Capital One Auto Finance

Why Capital One Auto Finance is a Good Choice:

Capital One offers prequalification tools that help you see potential rates and terms without impacting your credit score. This feature is invaluable for those with bad credit, as it allows you to shop around without the fear of multiple credit inquiries.

Key Features:

- Prequalification: Allows you to check rates without a hard credit pull.

- Loan Types: Offers loans for new and used cars, as well as refinancing options.

- Dealer Network: Requires that you purchase through a network of approved dealerships.

Autopay

Why Autopay Stands Out:

Autopay is another online marketplace that connects borrowers with multiple lenders. It’s particularly known for its wide range of refinancing options, which can be a lifesaver if you’re looking to lower your current loan’s interest rate.

Key Features:

- Multiple Offers: Provides access to various loan offers from different lenders.

- Loan Amounts: Ranges from $2,500 to $100,000, with terms from 24 to 96 months.

- Co-applicants: Allows you to apply with a co-applicant, which might help in securing better rates.

Each of these lenders offers unique benefits and terms, so it’s crucial to evaluate what aligns best with your financial situation and needs. Whether it’s the convenience of Carvana’s online shopping or the flexibility of Autopay’s refinancing options, there’s likely a solution that will help you drive your dream car even with bad credit.

Tips for Improving Your Loan Terms

When dealing with bad credit car loans, getting the best terms possible can make a big difference in your overall financial health. Here are some tips to help you improve your loan terms:

Prequalification

Prequalification is a smart first step. It allows you to see potential interest rates and loan terms without impacting your credit score. This is particularly useful for those with bad credit, as it lets you explore your options without the fear of multiple credit inquiries. Many financial institutions offer prequalification tools that can help you shop around and compare rates.

Co-signers

Having a co-signer can significantly improve your chances of securing a better loan. A co-signer with a strong credit profile can help you qualify for lower interest rates and better terms, as the lender takes into account their creditworthiness as well as yours. This can be a family member or a trusted friend who is willing to vouch for your ability to repay the loan.

Refinancing

If you already have a car loan, refinancing can be a great way to lower your interest rate and monthly payments. Once your credit improves, consider refinancing your loan to take advantage of better terms. There are many services available that offer a wide range of refinancing options and can connect you with multiple lenders to find the best rate.

Additional Tips

- Down Payment: Increasing your down payment can reduce the amount you need to borrow, which might help you secure a better interest rate.

- Shop Around: Always compare offers from multiple lenders. As noted in the research, shopping around can help you find the best rate for your loan, especially since lower credit can mean higher interest rates.

- Credit Improvement: While it may not be a quick fix, improving your credit score can eventually lead to better loan terms. Paying bills on time, reducing debt, and checking your credit report for errors are all ways to boost your credit over time.

By taking these steps, you can improve your chances of getting more favorable loan terms, even if you have bad credit. Up next, we’ll tackle some of the most frequently asked questions about bad credit car loans to help you steer the process with confidence.

Frequently Asked Questions about Bad Credit Car Loans

Can I get a car loan with a credit score of 500?

Yes, you can get a car loan with a credit score of 500, but options will be limited. Lenders view this score as high risk, which means you’ll face high interest rates. Some lenders specialize in subprime auto loans for those with very low credit scores. However, be prepared for the cost of borrowing to be significantly higher.

What’s the lowest credit score to get a car loan?

While there isn’t a strict minimum credit score universally applied, many lenders set their own thresholds. For instance, some lenders might work with scores as low as 500, but these loans typically come with higher interest rates and less favorable terms. It’s crucial to shop around and explore different lenders, as options and requirements can vary.

How can I improve my chances of getting a car loan?

Improving your chances of securing a car loan involves several strategies:

- Increase Your Down Payment: A larger down payment reduces the loan amount and shows lenders you have a stake in the purchase. This can sometimes offset the impact of a low credit score.

- Consider a Co-signer: Adding a co-signer with good credit can improve your approval odds and potentially lower your interest rate. This person will share the responsibility for the loan, so choose someone who trusts you to make payments on time.

- Opt for Used Auto Loans: Used cars often come with smaller loan amounts, making them more accessible to those with bad credit. Plus, used cars depreciate less quickly, which can be appealing to lenders.

- Shop Around: Don’t settle for the first offer you receive. Compare loans from different lenders, including banks, credit unions, and online platforms, to find the best terms.

- Work on Your Credit: While this is a longer-term strategy, improving your credit score can open up better loan options. Pay bills on time, reduce existing debts, and check for errors on your credit report.

By employing these strategies, you can improve your chances of securing a car loan, even with bad credit. Next, we’ll dive into the conclusion and explore how All Used Cars LLC can assist you in finding competitive prices through their extensive dealer network.

Conclusion

Navigating bad credit car loans can be daunting, but with the right support, you can drive away in a car that suits your needs and budget. That’s where All Used Cars LLC comes in.

We take pride in our extensive dealer network across the USA, spanning states from sunny California to busy New York. This vast network means you have access to a wide selection of top-quality used vehicles, ensuring you find the perfect match for your needs.

But it’s not just about having options—it’s about competitive prices too. We understand that when you’re dealing with bad credit, every dollar counts. That’s why we work hard to offer financing solutions that are both fair and affordable, helping you get back on the road without breaking the bank.

Our team is dedicated to providing a positive and stress-free car buying experience. From the moment you step onto our lot or visit our online service page, you’ll find a commitment to transparency and customer service that sets us apart.

So, whether you’re in Alabama or Ohio, or anywhere in between, we’re here to help you drive your dreams. Explore our selection today and find how easy it can be to secure a car loan, even with bad credit.