Car finance for students: 5 Best Deals in 2024

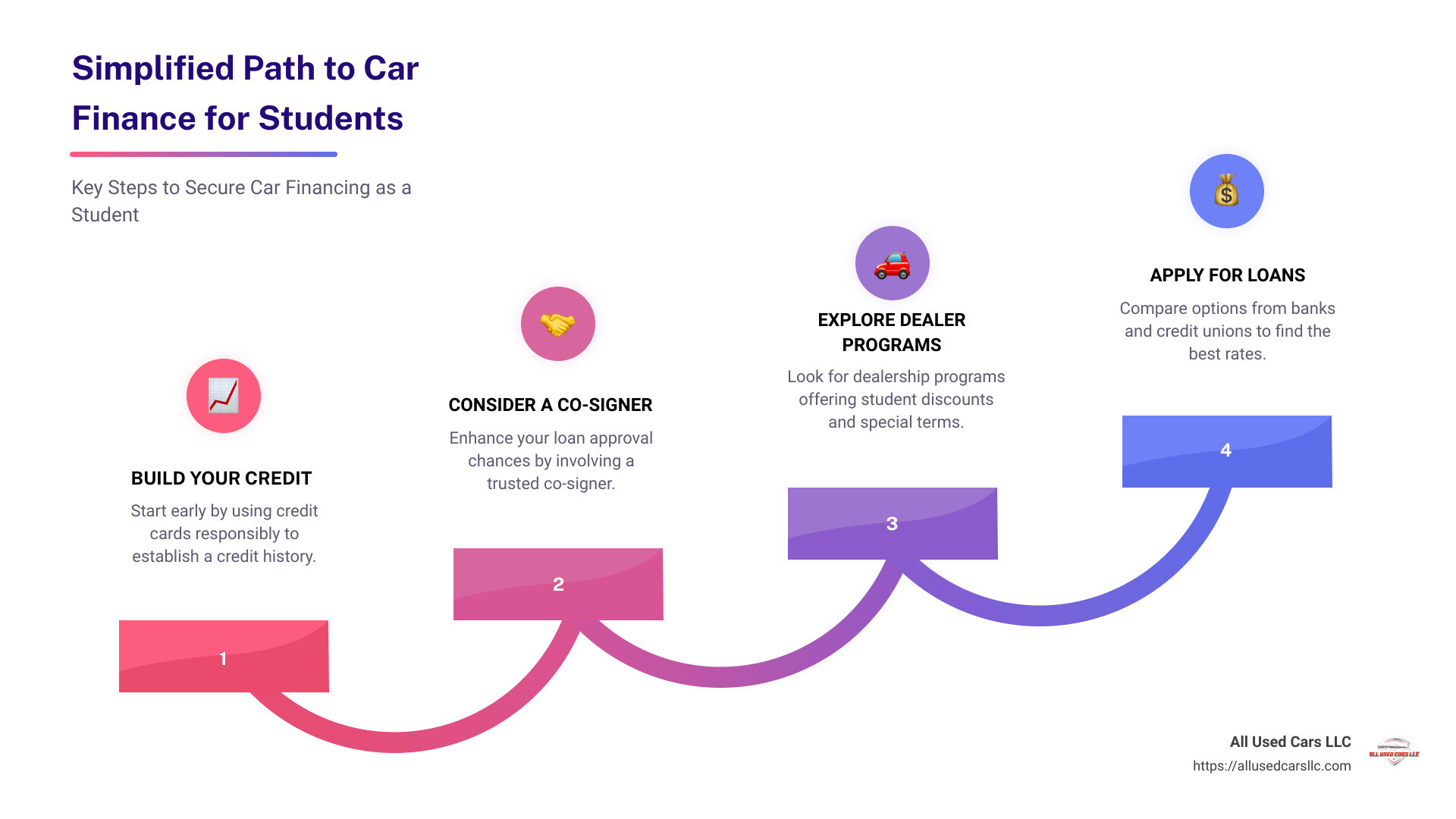

Car finance for students can often feel like navigating a maze, especially when balancing tuition fees and other college expenses. But don’t worry, finding a solution doesn’t have to be complicated. Here’s a quick overview of what you need to know:

- Overview: Whether it’s for getting to campus or work, a car can be essential. As students, borrowing options might feel limited, but several pathways exist to explore car loans custom to your needs.

- Challenges: Students face unique problems like limited credit history and inconsistent income, making loan approvals trickier. It’s common to balance between schoolwork, jobs, and these financial commitments. Paying monthly premiums without overloading an already tight budget adds to the challenge.

- Opportunities: Options like student discounts from dealerships and custom loan programs can make financing more accessible. Start by building your credit or consider a co-signer to improve your chances. Public or university partnered resources might also offer unfinded avenues.

Across various states, institutions like Germain Honda of Ann Arbor show how collaborating with local banks and using programs like the Honda College Graduate Program can open doors. Such options offer students boosted buying power, including perks such as deferred payments or reduced rates.

Simple Car finance for students word guide:

Understanding Car Finance for Students

Navigating car finance for students can be daunting, but understanding the key elements can make the journey smoother. Let’s break down the essentials: financial stability, credit history, and the role of a cosigner.

Financial Stability

Lenders want to ensure that borrowers can repay their loans. For students, this means demonstrating a stable income. Whether it’s from a part-time job, a stipend, or another reliable source, showing consistent earnings is crucial. If you’re working while studying, keep records of your income to present to potential lenders.

Tip: If you’re struggling to show stable income, consider pooling resources with a roommate or friend to share car expenses.

Credit History

A well-established credit history can significantly affect your loan approval chances. However, many students have limited or no credit history. This is where your credit report becomes vital. Lenders look for any signs of financial responsibility, even if it’s just a history of paying bills on time.

If your credit history is sparse, start small. Consider a secured credit card or a student credit card to build your credit. Pay off balances in full each month to avoid interest and to build a positive credit record over time.

Cosigner

A cosigner can be a game-changer for students seeking car loans. This is someone with a good credit history who agrees to take responsibility for the loan if you can’t make payments. A cosigner reduces the risk for lenders, often resulting in better loan terms and lower interest rates.

Remember: Your cosigner should be someone who trusts you financially, as their credit will be impacted if you fail to make payments.

Using these strategies, you can improve your chances of securing a car loan as a student. Whether it’s through building credit, proving financial stability, or finding a reliable cosigner, taking these steps can steer you towards a successful car financing experience.

Where to Find Car Finance Options

Finding the right car finance for students involves exploring various options custom to your unique situation. Here are some of the most accessible places to look:

School Affiliations

Many colleges and universities partner with financial institutions to offer special loan programs for students. These partnerships can provide more favorable terms, such as lower interest rates or more flexible eligibility requirements.

For example, some credit unions work with universities to offer financial products like auto loans to enrolled students. Check if your school has similar affiliations to simplify your search.

Banks and Credit Unions

Banks and credit unions are traditional sources for car loans. Some institutions offer programs specifically designed for students, which might include lower or no credit score requirements.

Credit unions, in particular, are known for offering competitive interest rates. According to the Credit Union National Association (CUNA), the median rate for a $40,000 car loan from a credit union is significantly lower than what you might find at a bank.

Dealerships

Car dealerships often have financing options and may offer special deals for students. Some manufacturers provide student discounts on certain models, which can be an added incentive.

For instance, some manufacturers offer bonus cash on select models, making it easier for students to afford a new car. Similarly, some financial services provide financial incentives for recent graduates, including down payment assistance.

Online Lenders

Don’t overlook online lenders, which can offer convenience and competitive rates. These platforms allow you to compare different loan offers quickly and easily. However, verify the credibility of online lenders to ensure you’re getting a fair deal.

By exploring these avenues, you can find a car financing option that suits your needs as a student. Whether it’s through your school, a local credit union, or a dealership, there are plenty of opportunities to secure a loan that fits your budget.

Top Car Finance Programs for Students

When it comes to car finance for students, several programs stand out. These initiatives offer financial relief and incentives that cater to students’ unique needs. Let’s explore some top car finance programs designed specifically for students.

GM College Appreciation

The GM College Appreciation program is a great option for students and recent graduates. It offers $500 off eligible new Chevrolet vehicles. This discount applies to current college students, graduate students, and those who have graduated within the last two years. Plus, qualifying borrowers can extend this benefit to their spouses, adding a layer of flexibility.

Ford College Student Purchase Program

Ford’s program provides up to $750 in bonus cash when purchasing select models. It’s designed to help students and recent grads afford a new vehicle with a little extra financial cushion. Ford also offers a leasing option, with up to $500 in bonus cash, making it a versatile choice for students who might prefer leasing over buying.

Honda Financial Services

Honda’s program is custom for recent graduates, offering $500 toward a down payment or the total cost of select models. To qualify, students must have graduated within the last two years or be set to graduate in the next six months. This program is ideal for those who are transitioning into the workforce and need reliable transportation.

Kia Happy Kia First Time Buyer Program

Kia’s program is crafted for first-time buyers, including students. It provides loans for both new and used vehicles without requiring a credit history or down payment. However, students need a monthly income of at least $2,000, which may be challenging for some. Despite this, the program offers a viable option for many students looking to purchase their first car.

These programs are designed to support students in navigating the complexities of car financing. By offering discounts and flexible terms, they make it easier for students to drive away in a vehicle that suits their needs and budget.

How to Improve Your Chances of Approval

Navigating car finance as a student can be tricky. But fear not! Here are some straightforward tips to improve your chances of getting approved for a car loan.

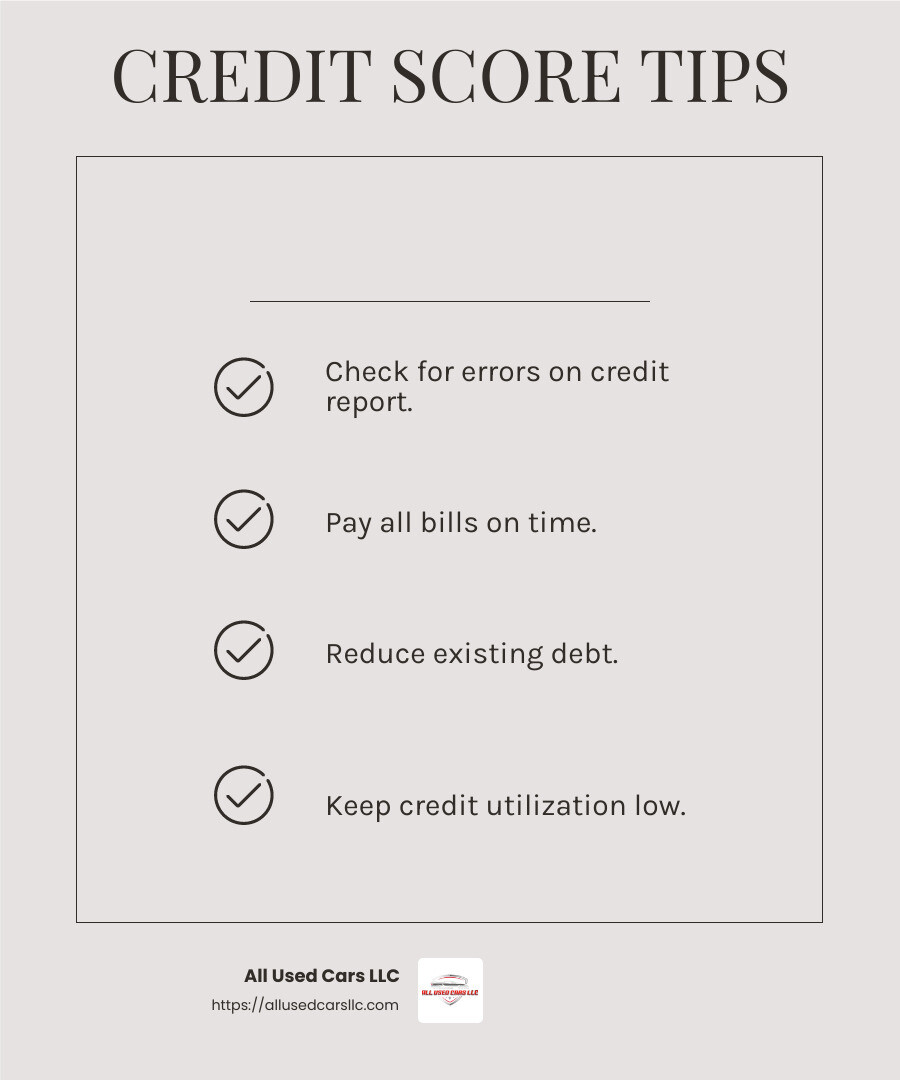

Boost Your Credit Score

Your credit score is a big deal when applying for a car loan. Lenders use it to decide if you’re a reliable borrower. A score of 680 or above is ideal, but even if yours is lower, there are ways to improve it:

- Check for errors: Pull your credit report from sites like AnnualCreditReport.com and dispute any mistakes you find.

- Pay bills on time: This is crucial. Late payments can hurt your score.

- Reduce debt: Try to pay down any existing credit card balances.

- Keep credit utilization low: Aim to use only 25%-30% of your available credit.

Show Stable Income

Lenders want to know if you can make your monthly payments. Having a stable income is key. If you’re working part-time or have a side gig, make sure to document your income. Even if it’s not a full-time job, showing consistent earnings can help.

Save for a Down Payment

A down payment can significantly improve your chances of approval. It reduces the amount you need to borrow and shows the lender you’re serious. Even a small down payment can make a difference. If possible, delay buying a car until you can save up a bit of cash.

Consider a Cosigner

If your credit score isn’t great or your income is low, a cosigner can be a game-changer. A cosigner with a strong credit history can help you secure a loan with better terms. Just remember, if you miss payments, it can affect both your credit and your cosigner’s credit.

Shop Around

Don’t just accept the first loan offer you get. Shop around at banks, credit unions, and dealerships. Compare interest rates and terms to find the best deal. This way, you can ensure you’re getting the most affordable option available.

By focusing on these areas, you’ll be in a stronger position to get the car loan you need. Next, let’s tackle some common questions students have about car finance.

Frequently Asked Questions about Car Finance for Students

Can a student get a loan for a car?

Yes, students can get a loan for a car, but there are some things to consider. Loan options are available through banks, credit unions, and dealerships. However, students often face challenges due to limited credit history and income. A cosigner can significantly improve your chances of approval. A cosigner is someone with a good credit score who agrees to take on the responsibility of the loan if you can’t make the payments. This can help you secure better interest rates and terms.

When comparing lenders, it’s important to look at more than just the interest rate. Consider the loan term, fees, and any additional requirements. Some lenders may offer special programs for students, so it’s worth shopping around to find the best deal.

Do car dealerships offer student discounts?

Yes, many car dealerships and manufacturers offer student discounts. These discounts can make buying a car more affordable for students. For example, programs like the GM College Appreciation and Ford College Student Purchase Program provide special offers for students and recent graduates. It’s a good idea to ask dealerships about any manufacturer discounts or dealership offers available.

These discounts can vary, so it’s important to do your research and ask the dealership directly. Sometimes, these offers include reduced prices, lower interest rates, or even rebates.

Can an 18-year-old get a car loan without a cosigner?

An 18-year-old can get a car loan without a cosigner, but it can be challenging. Credit requirements are often stricter for young borrowers. Having a good credit score and a stable income is crucial. If you have a limited credit history, you might face higher interest rates.

Income stability is another key factor. Lenders prefer borrowers who can show consistent income. Even if you’re working part-time, having proof of regular income can help your application.

While it might be tougher to get approved without a cosigner, it’s not impossible. You may need to explore different lenders and be prepared to handle higher interest rates if your credit score is low or your income is unstable.

Conclusion

Navigating car finance for students can seem daunting, but the right resources make all the difference. At All Used Cars LLC, we pride ourselves on offering a wide range of financing options specifically custom for students. Our extensive dealer network spans across the USA, ensuring you have access to top-quality cars at competitive prices.

Whether you’re in Alabama, California, or New York, our dealerships provide personalized assistance to help you find the best car finance solutions. We understand the unique challenges students face, from limited credit history to balancing budgets. Our partnerships with banks and credit unions allow us to offer flexible financing plans that cater to your needs.

Competitive pricing is just one part of our commitment to making car ownership accessible for students. We also offer secure financing options, ensuring that your car-buying journey is smooth and hassle-free. By choosing All Used Cars LLC, you’re not just buying a car; you’re investing in a reliable partner who will support you every step of the way.

Explore our used cars for sale and find out how we can help you drive away with confidence.